Independent Contractors

Self-employed individuals that provide services are independent contractors.

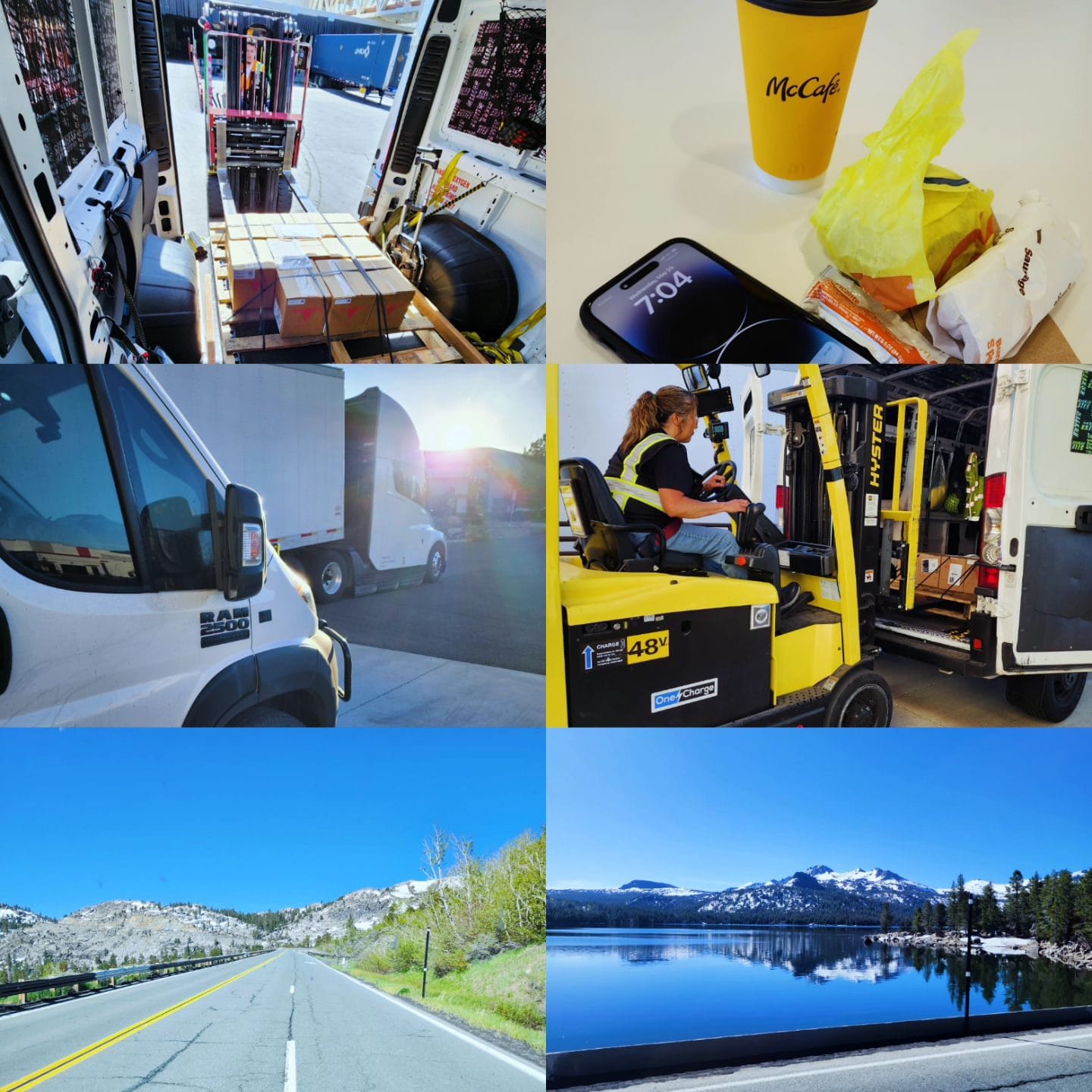

I abandoned my W-2 career a year ago and became a 1099 contractor. There are many reasons why I chose to stop working for W-2A and become a 1099 worker, but I won't discuss those reasons in this article. Instead but, I will tell you about the wonderful world of independent contractors.

Who Is a 1099 Worker or Independent Contractor?

According to the Internal Revenue Service, doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers in an independent trade, business, or profession where they offer their services to the general public are generally independent contractors. In other words, you are self-employed if you are an independent contractor.

Whether these people are independent contractors or employees depends on the facts in each case. The general rule is that an individual is an independent contractor if the payer/client has the right to control or direct only the result of the work and not how the individual or business will accomplish the job.

Here are some things to consider when working as an independent contractor:

Autonomy and Flexibility

Working as an independent contractor can be a good fit for people who enjoy autonomy and flexibility and are comfortable managing their finances and taxes.

Independent contractors are self-employed individuals who work with clients on a temporary or contracted basis rather than as direct employees. As such, you can set your expectations and timelines. If the client agrees with the terms, you can do the job at your own pace without having the client nagging you. Give yourself plenty of "cushion time" in case something happens. The best part, in my opinion, is that you know your worth and, therefore, what to charge your clients.

Taxes

Independent contractors are responsible for paying their taxes, including self-employment tax, a combination of Medicare and Social Security taxes.

I use a third-party payroll company to manage my paycheck and taxes.

Protections

Independent contractors may not have the same legal protections as full-time employees. For example, they may face more challenges in disputes with clients or companies over late payments, contract breaches, or disagreements.

I have a few protections in place. It is essential to have things in writing and adhere to the agreed work and timelines to avoid delays or misunderstandings.

Management

Independent contractors manage their time and finances, including tracking income and expenses, paying for insurance, and making retirement contributions.

Again, I use a third-party company to track my income and expenses. I also save all the physical maintenance invoices and receipts.

There is something about managing your time and finances that makes it so rewarding! It feels good knowing that all your hard work and effort pays off.

Communication

Independent contractors often spend much time interacting with clients and other professionals to ensure that projects are on track.

I mainly communicate via text messages or email and through a phone call if it is an emergency. By the way, I have two cell phones with two different carriers. As an independent contractor, you need to be reachable.

Training

Suppose you are in any of the professions mentioned earlier in this article. In that case, you don't need any specialized training to be an independent contractor, but you may need a business license, depending on your area and specialty.

For example, I have DOT HM-181 HazMat Training and TSA TWIC credentials, which allow me to work in ports, airports, and military/government installations. TWIC, or Transportation Worker Identification Credential, is a Transportation Security Administration (TSA) and United States Coast Guard initiative. These certifications allow me to access a wider clientele as an over-the-road expedited. However, they are not necessary to do what I do.

Final Thoughts

Are you tired of lazy coworkers or considering quitting your job? Consider becoming an independent contractor! Sure, the first year of becoming independent can be daunting, but after you clear that hump, it can be rewarding once you understand how things work. Are you an Independent Contractor, or are you considering becoming one? Let me know in a comment below! 🙂

Subscriber Discussion comments above are from subscribers to our blog.

Forum Discussion

The Forum Discussion comments above come from the official discussion topic for this entry.